🌽✨ Corn Futures (ZC1) — Market Snapshot ✨🌽

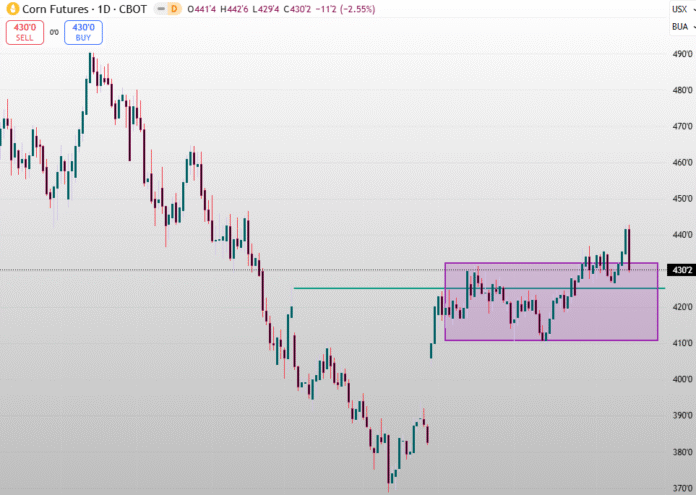

📈 Trend: Range-Bound

🌍 Corn futures posted modest gains this week after the U.S. government shutdown ends, but open interest dropped sharply, hinting at reduced conviction.

⚠️ Global competition and muted buying interest continue to weigh on prices.

📊 Technical Indicator: 🔁 Dard Cloud Cover

🧭 A Dark Cloud Cover pattern has emerged on the chart — a classic bearish signal indicating potential weakness ahead and caution for near-term buyers.

💰 Support: 🟢 425 USD/bu

🎯 Caution advised: Ongoing farmer selling at lower levels could cap any short-term recovery.

💵 Resistance Zone: 🔴 435 – 440 USD/bu

📉 Traders eyeing this zone for profit-taking or range-top resistance.

📊 Open Interest: 📄 450.30K contracts

🪙 Suggests strong market participation — indicating sustained hedging and speculative interest.

🛢️ Future Type: 🌽 Corn (ZC1)

📍 Traded on the Chicago Board of Trade (CBOT) — the benchmark contract for global corn pricing.

It’s a caution that the information provided is for knowledge purposes only and should not be taken as a recommendation to buy or sell assets.