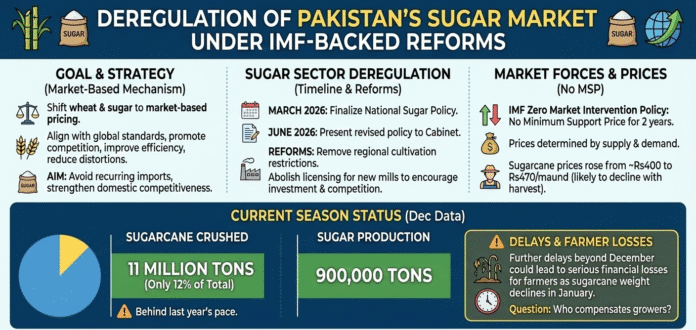

The federal government has decided to gradually withdraw state intervention from Pakistan’s agricultural commodity markets. This moves aims to align the sector with global standards. The government will shift wheat and sugar prices to a market-based mechanism to promote competition, improve efficiency, and reduce distortions.

As part of this strategy, the government has opted to fully deregulate the sugar sector. This step is intended to avoid recurring sugar imports and strengthen domestic competitiveness. Authorities plan to finalize a new National Sugar Policy by March 2026. The reform agenda also includes amendments to sugar sector licensing laws, along with changes to sugar price controls and import–export regulations. The revised sugar policy is expected to be presented to the federal cabinet for approval by June 2026.

The plan recommends removing regional restrictions on sugarcane cultivation and abolishing licensing requirements for establishing new sugar mills. Officials believe these steps will encourage investment, enhance competition, and improve overall sector performance.

During committee deliberations, members were informed that due to the IMF’s zero market intervention policy. The government has not announced a minimum support price for sugarcane for the past two years. In the absence of an MSP, market forces have determined prices based on supply and demand. As a result, sugarcane prices increased from around Rs400 per maund to Rs470 per maund; however, officials noted that prices are likely to decline again once the pace of harvesting accelerates

According to official data, mills have crushed approximately 11 million tons of sugarcane so far. Total production stands at 900,000 tons of sugar during the current season. Crushing activity remains significantly behind last year, with only 12 percent of total sugarcane crushed to date. Committee members warned that further delays in crushing beyond December could lead to serious financial losses for farmers, as sugarcane weight typically starts declining in January. They questioned who would compensate growers for these losses if crushing continues to lag.

The government maintains that the proposed reforms aim to create a transparent, competitive, and market-driven sugar sector while ensuring long-term sustainability for farmers and the industry alike.