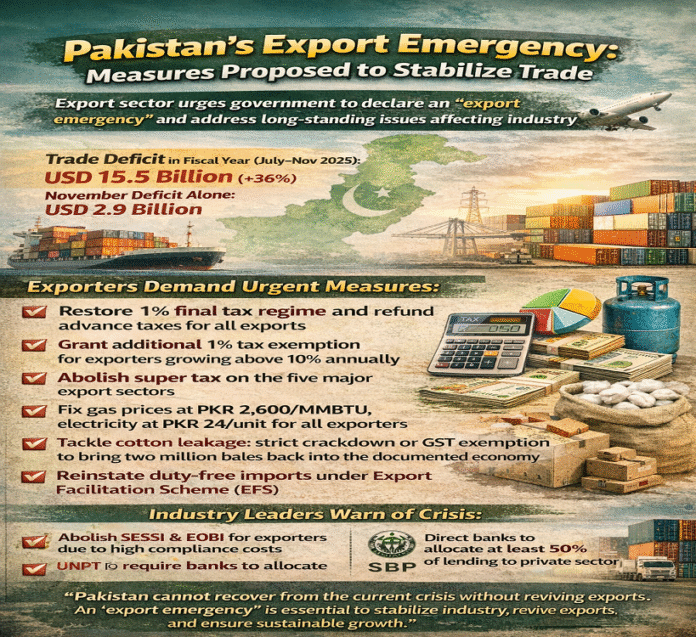

Pakistan’s export sector is urging the government to declare an “export emergency” and take immediate action to resolve long-standing issues affecting the industry. Rising costs, distortions in the tax regime, and disparities in energy prices have steadily eroded export competitiveness, pushing exporters to the brink. In just the first five months of the current fiscal year, the trade deficit has surged to approximately USD 15.5 billion, with November alone recording a deficit of USD 2.9 billion, a 36% increase year-on-year.

The sector has urged government to announce an export emergency through urgent and decisive measure;

- Restore 1% complete and final tax regime on all exports and refund advance taxes

- Grant an additional 1% tax exemption for exporters achieving over 10% annual export growth

- Abolish super tax on the five major export sectors

- Restore gas levy for export sectors: gas at PKR 2,600/MMBTU and electricity at PKR 24/unit for all exporters, whether captive or grid-connected

- Rationalize gas prices for the fertilizer sector, including price caps to prevent windfall profits and market distortions

- Reinstate items excluded from the Export Facilitation Scheme (EFS) for duty-free imports

Exporters have also urged the government to either enforce a strict crackdown to stop cotton leakage or exempt cotton from GST, which could bring approximately two million bales back into the documented economy. They have also demanded the abolition of SESSI and EOBI contributions for exporters, citing high compliance costs despite surplus funds and governance concerns. Additionally, they have called on the State Bank of Pakistan (SBP) to require banks to allocate at least 50% of lending to the private sector.

While textile industry is already facing challenging times and the government has transferred authority over cotton exports from the Trade Development Authority of Pakistan (TDAP) to the State Bank of Pakistan (SBP). Under the new rules, exporters must deposit 1% of the total contract value with SBP as a security deposit. SBP verification is mandatory along with shipping documents for all cotton exports. The SRO also requires buyers to open an irrevocable Letter of Credit (LC), and shipments of contracted cotton must be completed within 180 days. Failure to complete exports within the stipulated period will result in forfeiture of the security deposit.

Industry leaders emphasized that Pakistan cannot recover from the current crisis without reviving exports. Delays in implementing urgent measures may deepen economic contraction and force industrial shutdowns. An export emergency, backed by these measures, is expected to stabilize exports and support the government’s broader objectives of sustainable growth and successful exit from the IMF program.