As the world welcomed the New Year, two major developments from China and India delivered fresh shocks to the global textile industry, reshaping competitiveness at the very start of 2026.

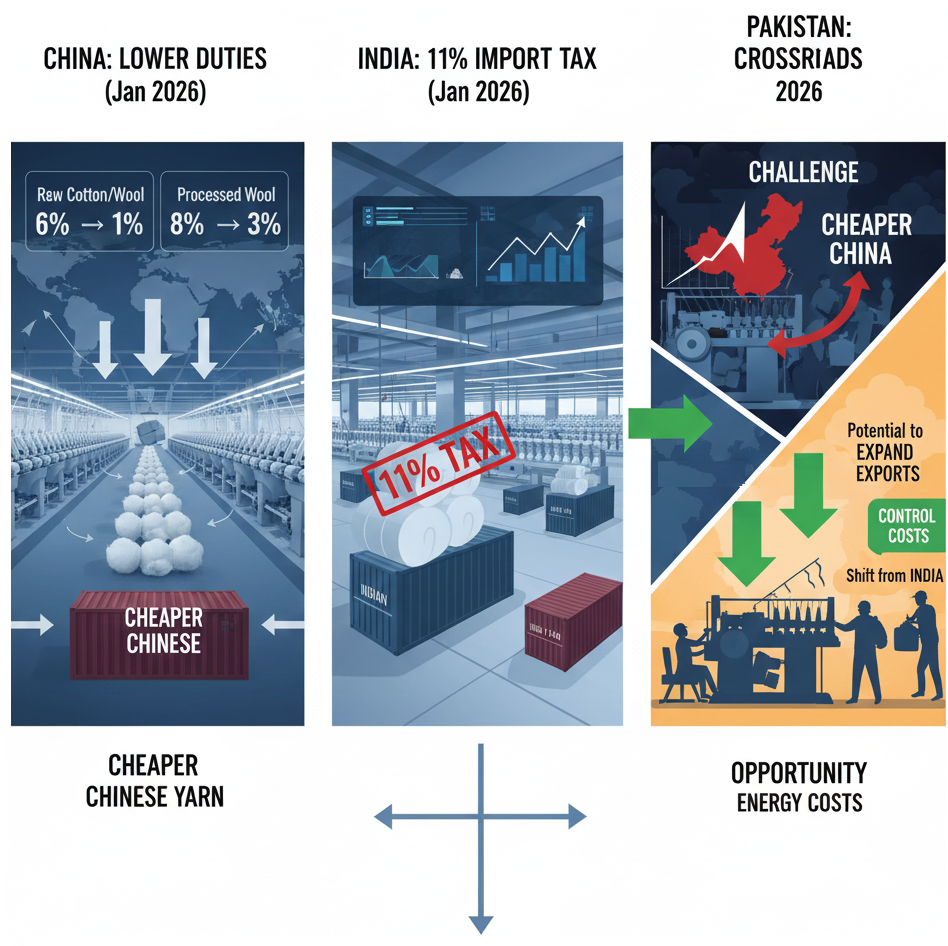

On January 1, 2026, China officially reduced import duties on in-quota raw materials to support and strengthen its spinning industry. The government cut duty on raw cotton and unprocessed wool from 6% to 1%, while reducing duty on processed wool, including combed and top spin wool, from 8% to 3%. This policy move aims to lower input costs for Chinese spinners and enhance their price competitiveness in the global yarn and textile market.

At the same time, India withdrew its duty-free import facility for cotton. As a result, Indian spinners must now pay an 11% tax on imported cotton, increasing their raw material costs and reducing their ability to compete on price in export markets.

For Pakistan, these developments present both challenges and opportunities. On the downside, cheaper Chinese yarn could enter international markets more aggressively, intensifying price competition for Pakistani spinners, particularly those focused on yarn exports that already compete directly with China.

On the positive side, India’s new 11% import tax is likely to raise the cost of Indian yarn. Buyers who previously sourced yarn from India may begin shifting orders toward alternative suppliers such as Pakistan and Vietnam. If Pakistan manages to control energy costs, especially electricity and gas tariffs, it could capture market share vacated by India. This opportunity is particularly strong in key importing markets such as Bangladesh and Thailand, where Pakistani yarn could gain improved access.

Overall, Pakistan’s textile sector enters 2026 under pressure from China’s aggressive cost-reduction strategy but also stands at a strategic crossroads, with the potential to expand its export footprint if domestic cost challenges are addressed effectively.