🌴 Palm Oil Futures (FCPOH2026) — Market Snapshot 🌴

📉 Trend: Short-Term Recovery

🚀 Exports weakened toward year-end, with shipments declining 5.2%–5.8% from November.

🌏 Crude oil prices slipped as the cartel prepares to meet virtually on January 4 to consider pausing further production increases.

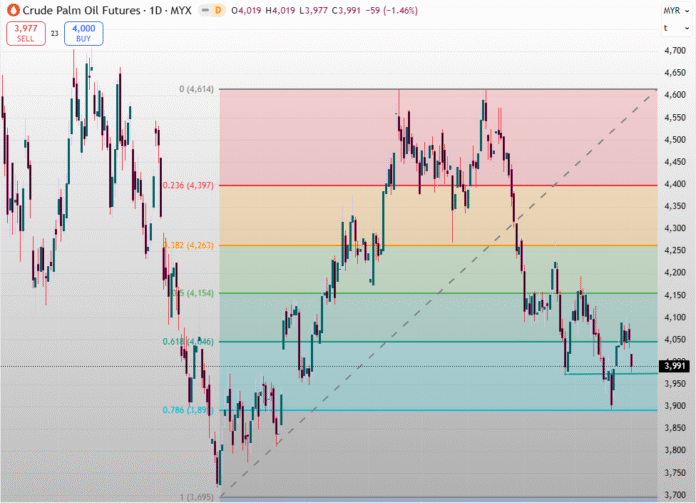

📊 Technical Indicator: 🔁 Fibonacci Retracement

🧭 Major resistance remains at 3,894 MYR/ton a crucial level to watch for a breakout. Fibonacci Retracement levels in play, with prices gradually edging toward the 78.6% level.

💰 Support: 🔹 3,894 MYR/ton

🎯 Traders watching for reversal signals around this zone for short-term entries.

📈 Open Interest: 74.44K contracts

🪙 Indicates moderate participation — possible buildup before next move.

🛢️ Future Type: Crude Palm Oil (FCPOH2026)

🌾 Benchmark Malaysian palm oil futures traded on Bursa Malaysia Derivatives.

It’s a caution that the information provided is for knowledge purposes only and should not be taken as a recommendation to buy or sell assets.