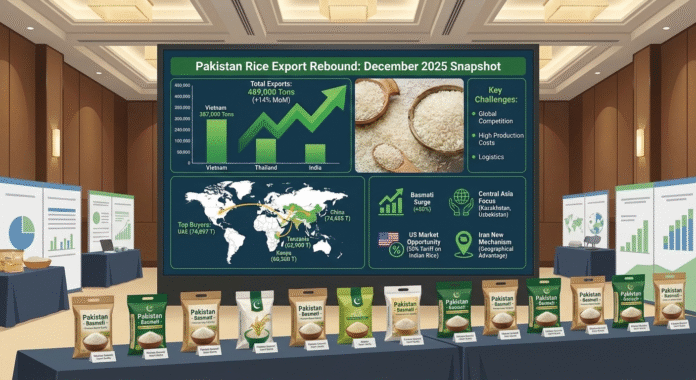

Pakistan’s rice exports rebounded strongly in December 2025, rising 14% month-on-month, led by a more than 50% increase in basmati shipments, according to trade data. This surge pushed Pakistan ahead of Vietnam, making it the world’s third-largest rice exporter for the month, behind India and Thailand. Total rice exports reached 489,000 tons, excluding shipments to Iran, compared to Vietnam’s 387,000 tons, marking Pakistan’s strongest monthly export performance to date.

The United Arab Emirates remained the top buyer, importing 74,897 tons (including 16,850 tons of basmati). China closely followed with 74,685 tons, while other major destinations included Tanzania (62,900 tons), Kenya (60,300 tons), Ivory Coast (41,700 tons), Guinea-Bissau (31,850 tons), Malaysia (23,930 tons), Madagascar (17,815 tons), and Saudi Arabia (16,032 tons, including 5,350 tons basmati). Combined exports to the EU and UK totaled 21,100 tons (15,600 tons basmati), with smaller shipments to Oman (5,770 tons), USA (2,230 tons), and Canada (1,321 tons).

A notable development is Pakistan’s growing presence in Central Asia. Exports to Kazakhstan exceeded 17,000 tons (10,300 tons basmati), while Uzbekistan received 10,382 tons. This reflects a structural shift, as exporters increasingly target Central Asian markets—including Kazakhstan, Uzbekistan, Azerbaijan, Turkmenistan, Tajikistan, and Kyrgyzstan—via direct routes after the Afghanistan border closure.

Despite strong performance, exporters highlight ongoing challenges, including structural, financial, marketing, and capacity constraints. Exports to Iraq remain minimal, while shipments to Turkey, Iraq, Jordan, Syria, and parts of Eastern Europe are limited. Government authorities have instructed the preparation of a comprehensive strategy to strengthen rice exports and reduce the trade deficit.

Industry analysts cite global competition particularly from India along with high production costs, weak international demand, rising freight and logistics costs, inconsistent financial policies, regulatory challenges, hoarding, and border security closures as key barriers.

At the same time, positive trends are emerging. Bangladesh shows strong demand despite high freight costs. Central Asian markets have shown growing appetite since the October 2025 harvest season. Pakistani exporters are also benefiting from the 50% US tariff on Indian rice, leading to gradual increases in shipments to the United States. Developments in Iran have created new opportunities, as importers now use own funds instead of subsidized foreign currency, giving Pakistan a geographical advantage over Indian competitors.