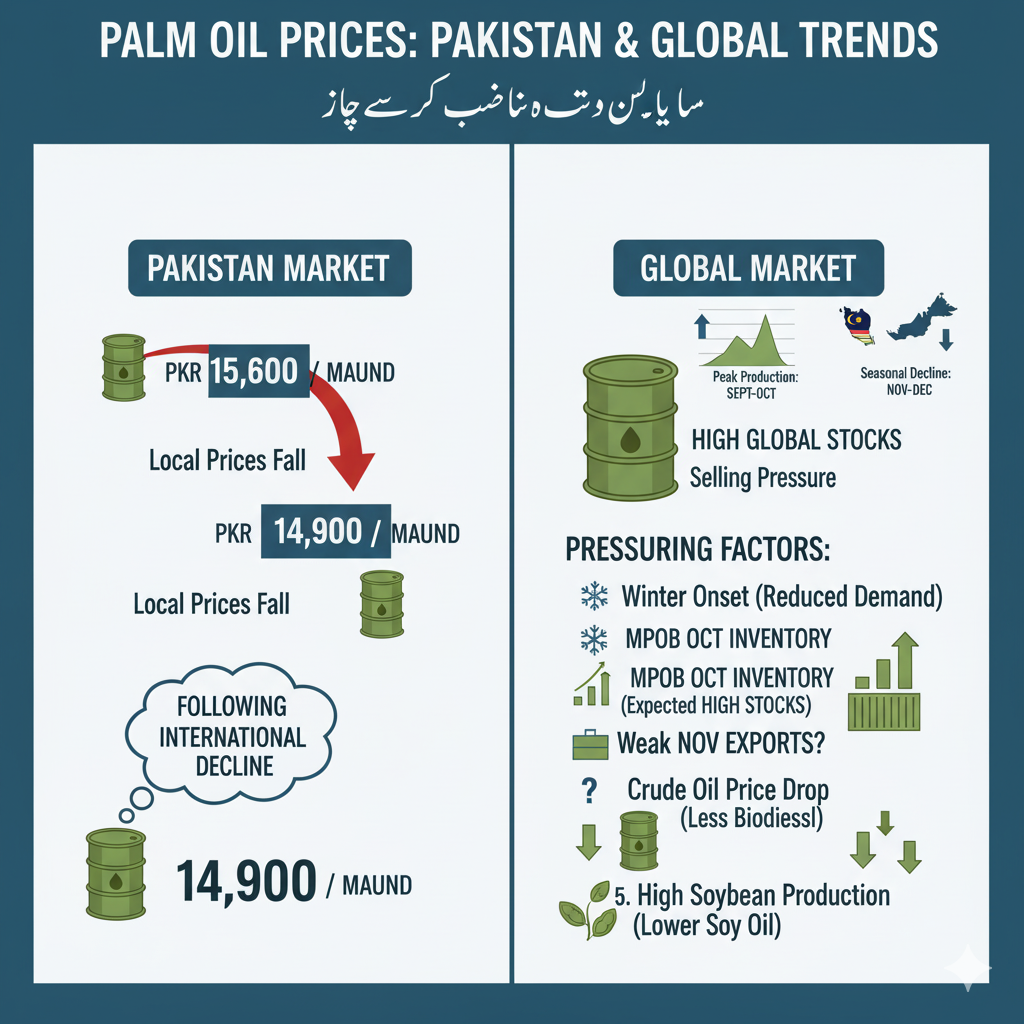

Palm oil prices in the local Pakistani market have fallen from PKR 15,600 to PKR 14,900 per maund, following a decline in international prices. While global palm oil production is expected to be slightly lower this season, overall stock levels remain relatively high due to robust production in previous months. Large inventories tend to exert selling pressure on prices.

In Malaysia, palm oil production typically peaks in September and October and declines seasonally in November and December. This seasonal drop in production can help reduce stocks and provide some support to prices.

However, several factors are keeping the market under pressure:

- Winter onset in the Northern Hemisphere, where major palm oil buyers are located, may reduce demand, as palm oil solidifies in cold temperatures, making usage more difficult.

- Malaysian Palm Oil Board (MPOB) October inventory data, expected in early November, indicates a larger-than-expected stock increase, potentially reaching a 22-month high, which would reinforce bearish sentiment.

- If export figures for early November fall below expectations, market confidence could be further weakened.

Other factors influencing palm oil prices include its use in biodiesel, which is closely tied to global crude oil prices. A sharp decline in crude oil prices reduces biodiesel demand, putting additional downward pressure on palm oil. Similarly, if soybean production in the U.S. and Brazil exceeds expectations, soybean oil prices are likely to fall, which could also negatively affect palm oil prices.