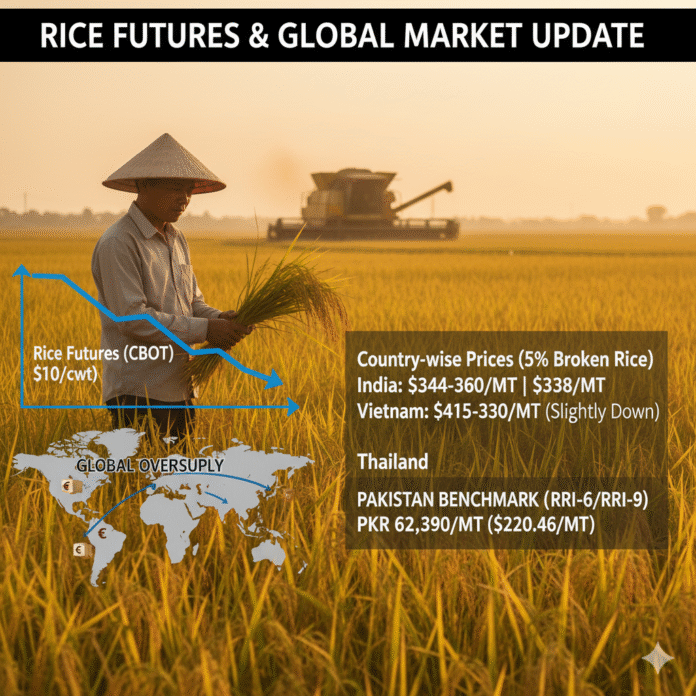

Rice futures continued their decline, trading just below $10 per cwt, the lowest level since September 2018, amid expectations of global oversupply. Bumper harvests in major Asian exporters, particularly India, along with increased stocks in China, Thailand, Indonesia, and Vietnam, have kept supply abundant. The UN FAO forecasts global rice production to reach a record 556.4 million tons in 2025–26, consequently, buyers are taking a more measured approach to procurement, and demand has remained subdued.

CBOT Rough Rice futures (U.S. No. 2) are trading at $10 per cwt, when converted to metric tons, using the standard factor of 22.046, this equals approximately 220.46 USD/MT (10 X 22.046). At an exchange rate of PKR 283/USD, this equates to PKR 62,390/MT. This benchmark is most relevant for Pakistan’s medium- to long-grain, non-aromatic varieties, IRRI-6 and IRRI-9. Any significant changes in CBOT futures prices should be reflected in local paddy prices to ensure Pakistan remains competitive in the international rice market.

Country-wise Prices (5% Broken Rice):

- India: Parboiled $344–$350/MT | White $350–$360/MT

- Vietnam: $415–$430/MT

- Thailand: $338/MT (slightly down from $340 last week)

Market reports indicate that paddy harvesting is gaining momentum in India due to dry weather, while Vietnam is in the early stages of its Mekong Delta harvest, exerting modest downward pressure on prices. Vietnam’s rice exports in October fell 56.2% YoY to 344,000 tons, with shipments for January–October down 7.5% to 7.17 million tons.