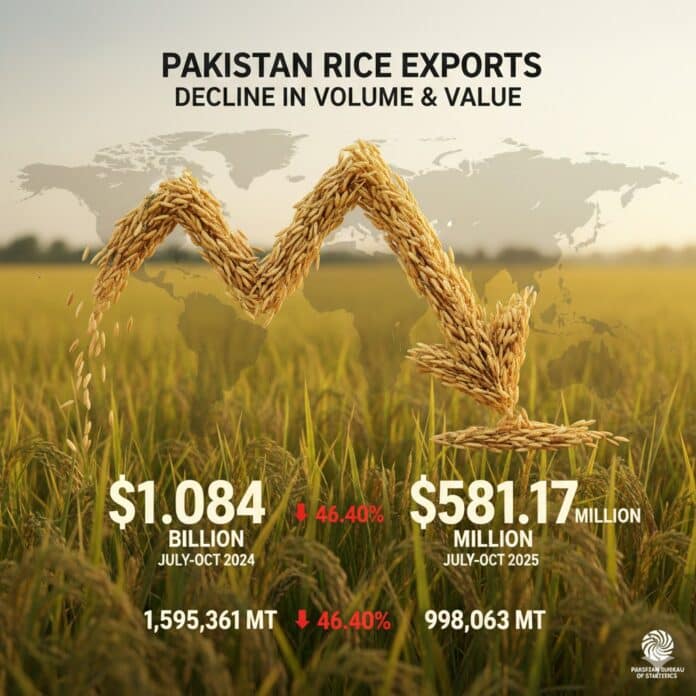

During the first four months of the current fiscal year, Pakistan exported 998,063 metric tons of rice, down from 1,595,361 metric tons in the same period last year. Between July and October 2025, rice exports earned $581.17 million, compared to $1.084 billion during the same period last year, marking a 46.40% decline in volume and value, according to the Pakistan Bureau of Statistics.

Breaking it down, Basmati rice exports totaled 182,807 metric tons, generating $202.36 million, compared to $331.82 million last year. Meanwhile, non-Basmati rice exports reached 815,256 metric tons, valued at $378.82 million, down from 1.277 million metric tons worth $752.38 million in the same period last year.

Some relief is expected from a new Bangladesh rice export order of 100,000 metric tons, with Jhulay Lal Company submitted the lowest bid in the tender. Eleven participants competed, but Jhulay Lal offered the lowest price at $394.98 per ton, while other bids ranged from $397.25 to $424.80 per ton (CIF liner out).

Despite this new order, Pakistan’s rice exports expect to remain below this year. Pakistan the fourth-largest rice exporter is losing ground to regional competitors after India lifted its export restrictions, while lower international market prices have further reduced Pakistan’s competitiveness.

Currently, India, Thailand, and Vietnam offer lower prices than Pakistan. For premium Super Basmati, Pakistan sells around $1,200 per ton, while India offers similar grades at $900 per ton. In the non-Basmati category, such as 5% broken rice, Vietnam and Thailand sell at $350 per ton, roughly 6% cheaper than Pakistan’s and India’s price of $370 per ton, causing a loss in market share.

Experts warn that declining rice exports could worsen Pakistan’s current account deficit, which is forecasted to reach around $3 billion in FY2026.