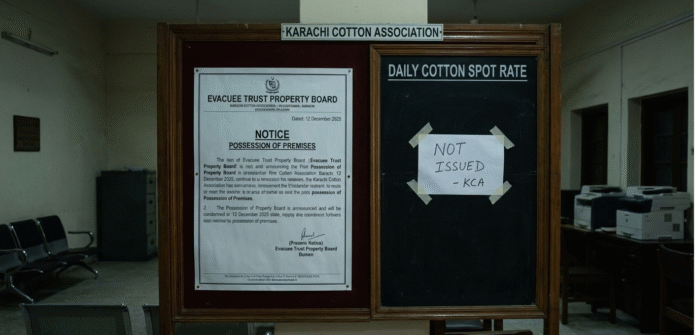

A serious situation has emerged around the Karachi Cotton Association (KCA) building, after the Evacuee Trust Property Board (ETPB) took possession of the premises on 12 December 2025. This sudden action has disrupted business activities for nearly 320 registered cotton brokers and tenants, who report daily financial losses running into millions of rupees. Affected stakeholders have demanded that authorities unseal the premises immediately and allow businesses to resume operations.

For the first time in its 52-year history, the Karachi Cotton Association has failed to issue the daily cotton spot rate. The absence of this benchmark has created serious uncertainty in the domestic cotton market, as the spot rate serves as a key pricing reference for traders, spinners, and exporters. Meanwhile, negotiations between the Evacuee Trust Property Board and KCA management continue in an effort to resolve the dispute.

Amid this uncertainty, cotton prices for quality lint remained largely stable during the past week, although trading volumes stayed subdued. The final week of 2025 coincided with bank holidays, which further tightened liquidity and added financial pressure on the market. According to data released by the Pakistan Cotton Ginners Association (PCGA) on 3 January 2026, total cotton arrivals reached 5,434,044 bales by 31 December 2025.

PCGA last year data show total cotton arrivals for the same period stands at 5,452,250 bales, indicating no significant year-on-year change. During the current season, textile mills consumed 4,708,380 bales, while exporters and other market participants purchased 176,000 bales. In comparison, last year’s consumption stood at 4,650,000 bales, with exports and market purchases totaling 180,000 bales.

National cotton stocks currently stand at 549,664 bales, including 481,966 pressed bales and 67,698 loose bales. This level remains slightly below last year’s stock of 588,531 bales. Cotton movement increased significantly to 132,636 bales, compared with 84,916 bales during the same period last year. At present, 223 ginning factories are operational across the country.

Cotton prices in Sindh and Punjab traded between PKR 14,000 and PKR 16,200 per maund, depending on quality and payment terms. Limited availability of phutti kept prices in the range of PKR 6,000 to PKR 8,000 per 40 kilograms. In Balochistan, lint prices ranged from PKR 15,500 to PKR 16,200 per maund, while phutti traded between PKR 7,800 and PKR 8,500 per 40 kilograms. Cottonseed cake and cottonseed oil prices remained largely stable.

Meanwhile, international cotton markets showed mixed trends, with New York cotton futures trading between 63 and 64 US cents per pound. Overall, the domestic cotton market remained subdued, with trading volumes staying limited.