According to PCGA’s report, Punjab’s cotton production stood at 2.168 million bales as of 15 November, showing a 3% decrease compared to last year, whereas Sindh recorded an increase of 2%, reaching 2.689 million bales.

Total cotton arrivals reached 4,856,505 bales, showing a slight decline of 0.77% compared to last year, mainly due to slower crop pace and weaker performance in Punjab. Punjab arrivals fell by 76,922 bales (-3.43%), reflecting crop stress and slower ginning, whereas Sindh performed better, with an increase of 39,479 bales (+1.49%), supporting the national supply.

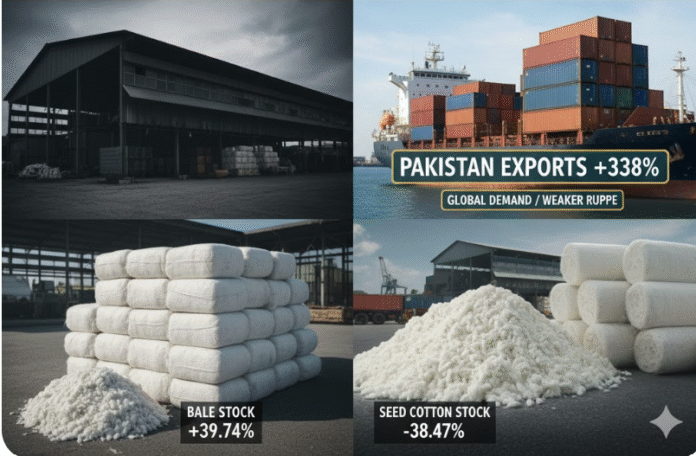

Exports saw a record surge to 166,600 bales (+338%), driven by strong global demand, competitive pricing, and a weaker rupee. This provides a positive signal for the market despite challenges in domestic consumption. Textile mill consumption, however, declined to 3,991,643 bales (-3.57%) due to high energy costs, weaker orders, and financial constraints, particularly in Punjab, where consumption dropped by 7.23%. Sindh’s textile consumption remained relatively stable, showing only a minor decline (-0.56%).

National stock levels totaled 698,262 bales, slightly lower than last year (-2.53%). Within this:

- Bale stock increased significantly to 460,033 bales (+39.74%), indicating faster ginning, slower mill purchases, and accumulation of finished stock.

- Seed cotton (phutti) stock fell sharply to 238,229 bales (-38.47%), reflecting lower arrivals and immediate conversion into lint.

The fortnightly flow dropped to 419,249 bales (-30.45%), showing that the crop has moved past its peak. Meanwhile, operational ginning factories reduced to 434 (-15.73%), with Punjab showing the greatest reduction (-52 factories) and Sindh performing comparatively better (-29 factories).

The combination of slower arrivals and weaker mill consumption suggests that prices may remain under pressure. However, the strong export momentum could provide support to the market in the coming months.