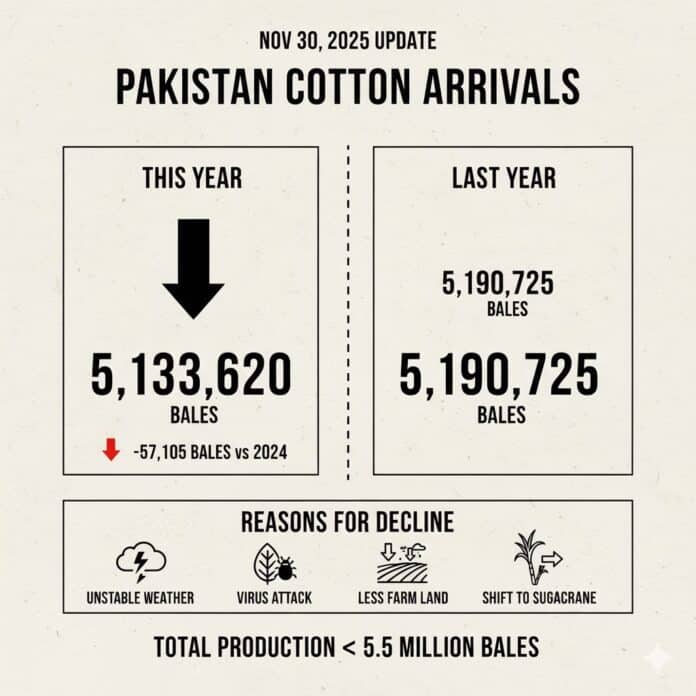

The latest update, based on nationwide data released by the Pakistan Cotton Ginners Association (PCGA) up to 30 November 2025, presents a detailed view of the ongoing cotton season. Total arrivals at ginning factories have reached 5,133,620 bales so far this year, slightly below last year’s figure of 5,190,725 bales. The reduction in arrivals reflects several factors, including unstable weather conditions, virus attacks, a decline in cultivated area, and the continued shift of farmland toward sugarcane, all of which have affected overall cotton production. It now appears that total production may fall below last year’s 5.5 million bales.

Exporters and traders have purchased 172,600 bales this season, showing a cautious stance in response to weak global market trends and international uncertainty. In contrast, domestic textile mills have lifted 4,293,763 bales, indicating stable internal demand and consistent order flows despite ongoing challenges such as high energy costs and operational expenses.

Current national cotton stocks stand at 667,257 bales, comprising 509,830 pressed bales and 157,427 seed-cotton (phutti). This stock position suggests an adequate supply in the market; however, if textile mills maintain their present procurement pace, available stocks may start to decline in the coming weeks. For comparison, stocks during the same period last year were recorded at 677,247 bales, around 10,000 bales higher, indicating a slightly weaker supply situation this season.

Fresh arrivals into ginning units total 277,115 bales, compared with 296,777 bales last year. This decrease highlights the impact of weather-related delays, local crop losses, and inconsistent production on the overall flow of phutti reaching factories. Currently, total 385 ginning factories are operational across the country, reflecting ongoing activity in both Punjab and Sindh.

Overall, PCGA’s data shows a season that remains balanced but under pressure. Arrivals are marginally lower than last year, textile buying continues to show strength, and exporters remain cautious due to the soft international market. The coming weeks will play a decisive role as the final phase of phutti arrivals, forward buying by textile mills, and global price movements toward year-end shape the direction of the domestic cotton market.

If international prices rise or the US dollar gains strength, the domestic cotton market may see improvement. Otherwise, current range-bound behaviour is likely to continue. While cotton arrivals have remained weaker this year, strong domestic demand has helped stabilize the market, and the future outlook will depend on global developments and policy decisions within the country.