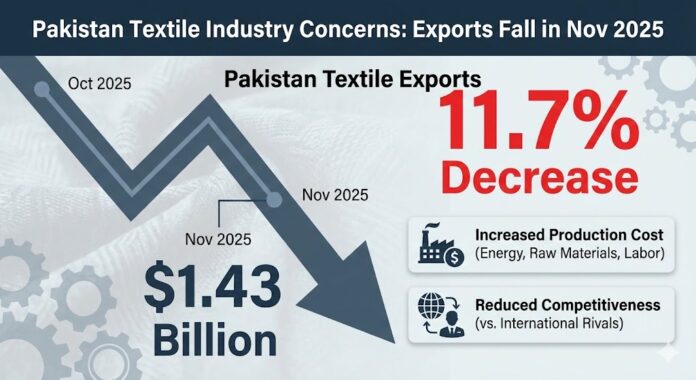

Pakistan’s textile exports fell to $1.43 billion in November 2025, marking an 11.7% decline compared to last month October, raising concerns across the textile industry. Contributing factors for this decline is the increase in cost of production which has made it difficult for manufacturers to compete against international competitors.

Textile & Apparel Performance: July–November FY26

- Total exports: $7.84 billion, up 2.8% Year on Year.

- Traditional textiles (raw materials & semi-finished goods): $1.28 billion, down 7.7% Year on Year. In the month of November saw an 18.5% Year on Year decrease.

- Garments and value-added textiles: $6.56 billion, up 5% Year on Year, but November exports declined 0.5% Year on Year, signaling slowing momentum even in Pakistan’s strongest export segment.

Pakistan’s textile and apparel sector is facing serious challenges, with rising production costs and slowing exports increasing the risk of large-scale job losses and factory closures. In Faisalabad, 40% of textile mills have closed double shifts due to higher costs. According to manufacturers, electricity costs in Pakistan are higher than in competing countries like Bangladesh, India, and Vietnam, where industrial electricity costs range from 0.7 to 0.9 cents per unit while in Pakistan it stands at 0.11 cents.

To support the industry, NEPRA has approved a uniform electricity tariff of Rs. 22.98 per unit for industrial and agricultural users for the next three years. Additional electricity will be supplied at subsidized rates:

- Agricultural users: Rate reduced from Rs. 38 per unit to Rs. 22.98 per unit.

- Industrial users: Rate reduced from Rs. 34 per unit to Rs. 22.98 per unit.

This industrial support package does not affect residential or commercial consumers. It aims to boost industrial and agricultural activity, enhance production, improve competitiveness, and create new employment opportunities across the country.