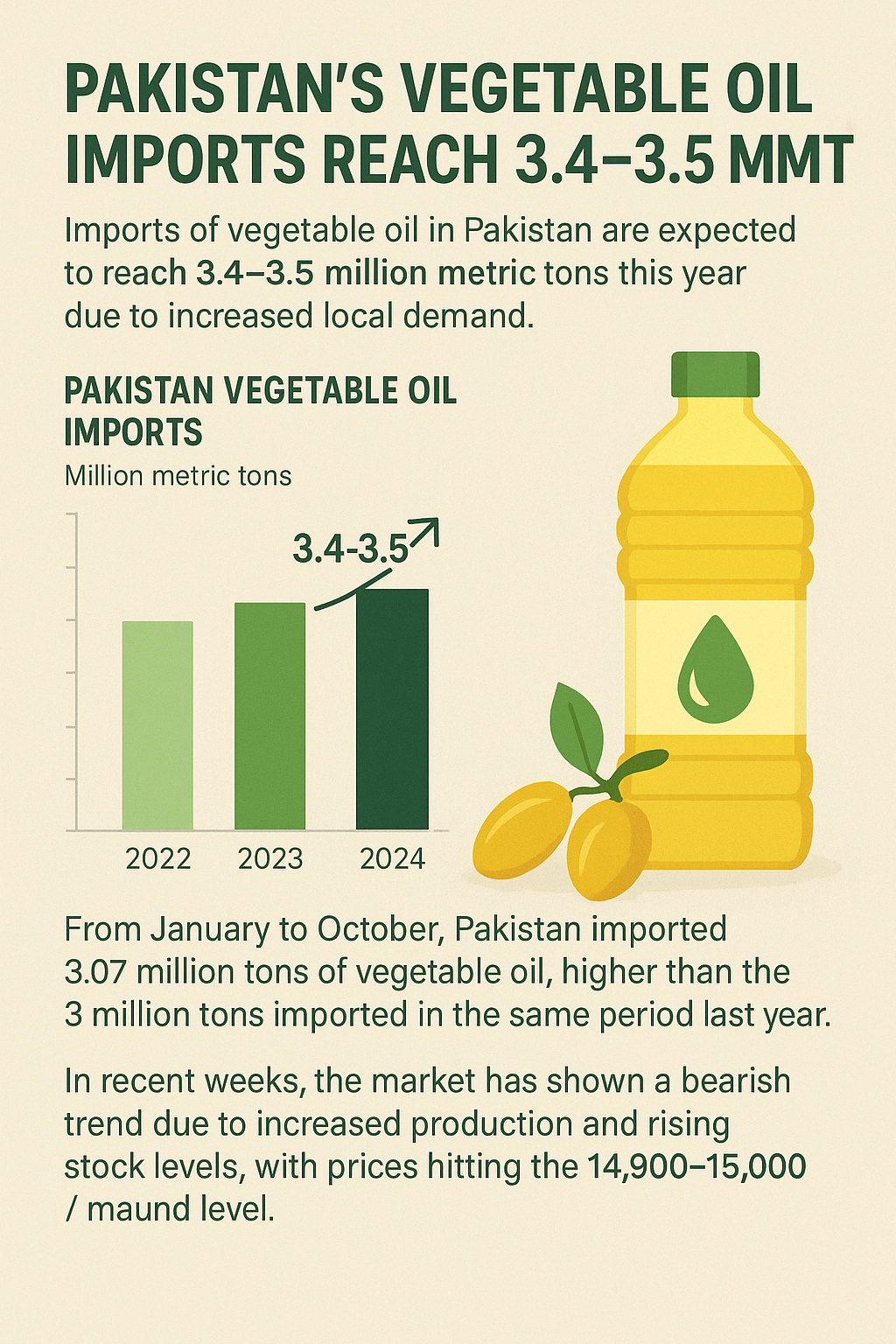

Imports of vegetable oil in Pakistan are expected to reach 3.4–3.5 million metric tons this year due to increased local demand. From January to October, Pakistan imported 3.07 million tons of vegetable oil, higher than the 3 million tons imported in 2024. This rise is mainly due to population growth and economic development.

He also mentioned that Pakistan imported around 2.9–3 million tons of oil annually between 2022 and 2024. Additionally, 2.2 million tons of oilseeds were imported from January to October.

However, in recent weeks, the market has shown a bearish trend due to increased production and rising stock levels, with prices hitting to 14,900-15,000 / maund level.

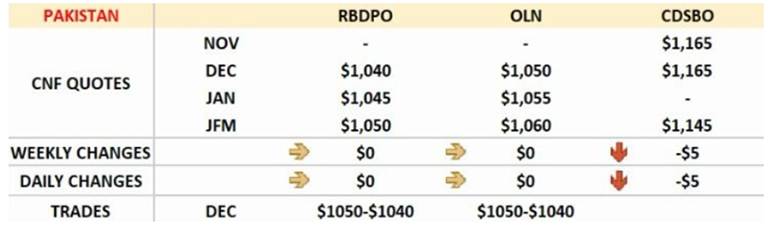

Below are the CNF offers for Pakistan;

Some analysts suggest that long-term international prices for 2025–2026 may rise because of supply risks and strong demand for biodiesel, but short-term pressures remain bearish. According to market technical analysts, the current market signals a Strong Sell, indicating that prices may decline further.

Palm oil prices generally follow soybean oil trends. Weak trends in soybean oil and palm olein on the Chicago Board of Trade and Dalian Commodity Exchange are also pushing palm oil prices down.

If the Malaysian Ringgit strengthens, palm oil becomes more expensive for international buyers, reducing demand and causing prices to fall. The Ringgit has recently strengthened. During today’s market opening and early session, traders are expected to continue selling as they react to rising production and weak export demand.