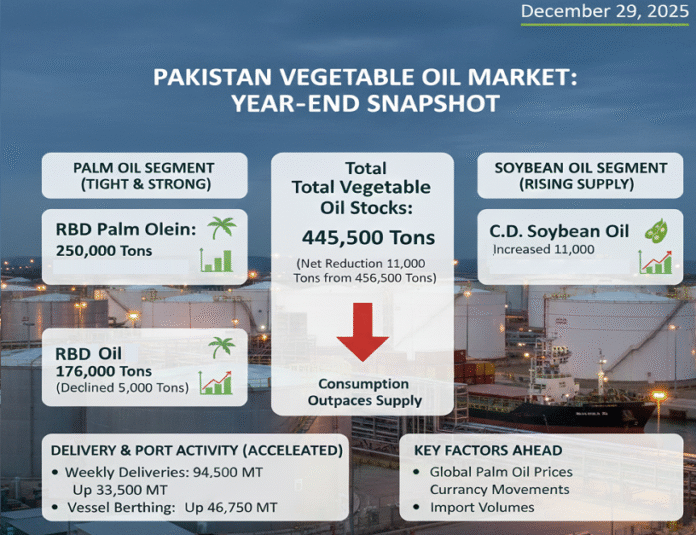

As of 29 December 2025, Pakistan’s total vegetable oil declined to 445,500 tons from 456,500 tons in the previous week, reflecting a net reduction of 11,000 tons. This confirms that consumption continues to outpace supply in the local market.

Market data shows that RBD Palm Olein stocks fell sharply to 250,000 tons, recording a weekly decline of 17,000 tons. This drop highlights strong and consistent demand, with stocks moving quickly despite regular supply inflows. RBD Palm Oil stocks also declined by 5,000 tons to 176,000 tons, reinforcing the tight but stable structure of the palm oil market. In contrast, the soybean oil segment moved in the opposite direction. C.D. Soybean Oil stocks increased significantly from 8,500 tons to 19,500 tons, marking a rise of 11,000 tons. This increase suggests fresh import arrivals.

Delivery activity accelerated sharply during the week. Weekly deliveries surged to 94,500 metric tons, up from 61,000 tons in the previous week, showing an increase of 33,500 tons. Port activity also strengthened, signaling improved import flow. Vessel berthing volumes increased to 122,500 metric tons, compared with 75,750 tons last week, reflecting a rise of 46,750 tons. While higher berthing levels point to better supply prospects in the near term, the current pace of consumption continues to limit immediate relief in market tightness.

Overall, palm olein and palm oil markets remain fundamentally strong, supported by declining inventories and robust deliveries. At the same time, rising soybean oil stocks may create short-term pressure in that segment. In the weeks ahead, global palm oil price trends, currency movements, and import volumes will remain key factors influencing local vegetable oil prices. Based on current indicators, Pakistan’s vegetable oil market remains sensitive, active, and firmly driven by demand toward year-end.