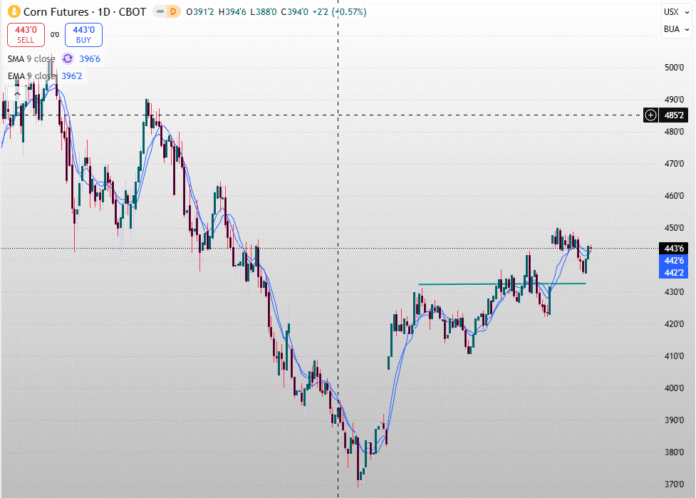

🌽✨ Corn Futures (ZCH2026) — Market Snapshot

📈 Trend: Range-Bound

🌍 Wheat & Crude futures created spillover pressure.

⚠️ South Korean importer purchased a total of 268,000 metric tons.

📊 Technical Indicator: 🔁 Fibonacci Retracement

🧭 Major resistance remains at 451 USD/bu, a crucial level to watch for a breakout.

💰 Support: 🟢 430-432 USD/bu

🎯 Caution advised: Ongoing farmer selling at lower levels could cap any short-term recovery.

💵 Resistance Zone: 🔴 450 – 455 USD/bu

📉 Traders eyeing this zone for profit-taking or range-top resistance.

📊 Open Interest: 📄 725.69K contracts

🪙 Suggests strong market participation — indicating sustained hedging and speculative interest.

🛢️ Future Type: 🌽 Corn (ZCH2026)

📍 Traded on the Chicago Board of Trade (CBOT) — the benchmark contract for global corn pricing.

It’s a caution that the information provided is for knowledge purposes only and should not be taken as a recommendation to buy or sell assets.