🧵✨ Cotton Futures (CT1) — Market Snapshot ✨🧵

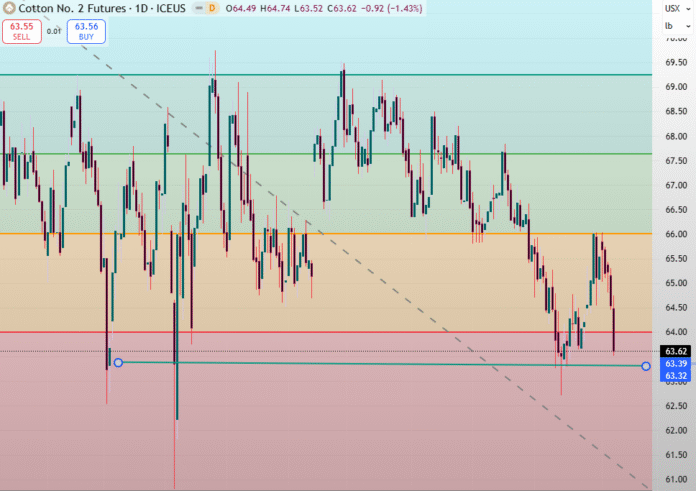

📉 Trend: Downward

💵 A stronger U.S. dollar, lower crude oil prices, and weak global demand continue to pressure prices.

🌍 Amid U.S. government uncertainty further weigh on market sentiment.

📊 Technical Indicator: 🔁 “Three Black Crows” Pattern

🐦 This bearish formation signals continued selling pressure, though prices are now approaching a key support zone — watch for a potential technical rebound if fundamentals stabilize.

💰 Support: 🟢 63.39 USD/lb

💵 Resistance Zone: 🔴 65.75 – 66.00 USD/lb

📉 A potential profit-taking area or range-top resistance for short-term traders.

📊 Open Interest: 📄 130.05K contracts

🪙 Indicates active participation, with both speculators and hedgers positioning amid market weakness.

🧶 Future Type: 🌾 Cotton (CT1)

📍 Traded on the Intercontinental Exchange (ICE US) — the global benchmark for cotton pricing.

It’s a caution that the information provided is for knowledge purposes only and should not be taken as a recommendation to buy or sell assets.