🧵✨ Cotton Futures (CT1) — Market Snapshot ✨🧵

📉 Trend: Upward

💵 Renewed U.S.–China trade discussions are boosting hopes for stronger Chinese demand, offering some upside support.

🌍 End of U.S. government shutdown concerns has added mixed sentiment, keeping gains measured.

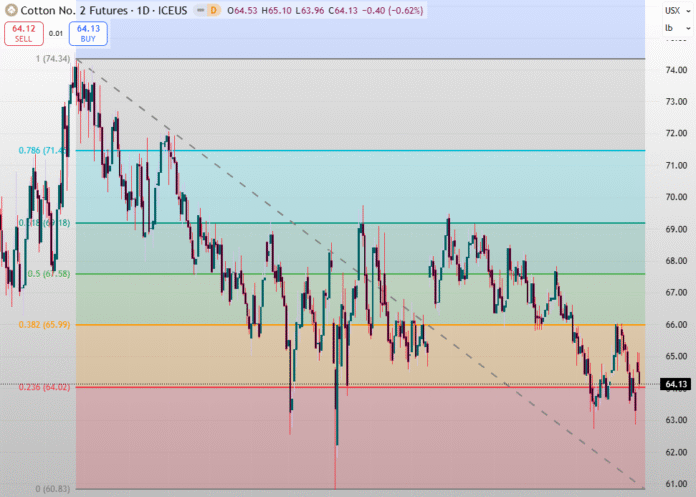

📊 Technical Indicator: 🔁 Fibonacci Retracement

🐦 Prices are currently hovering near the 23.6% Fibonacci retracement level, a strong support zone.

💰 Support: 🟢 64.06 USD/lb

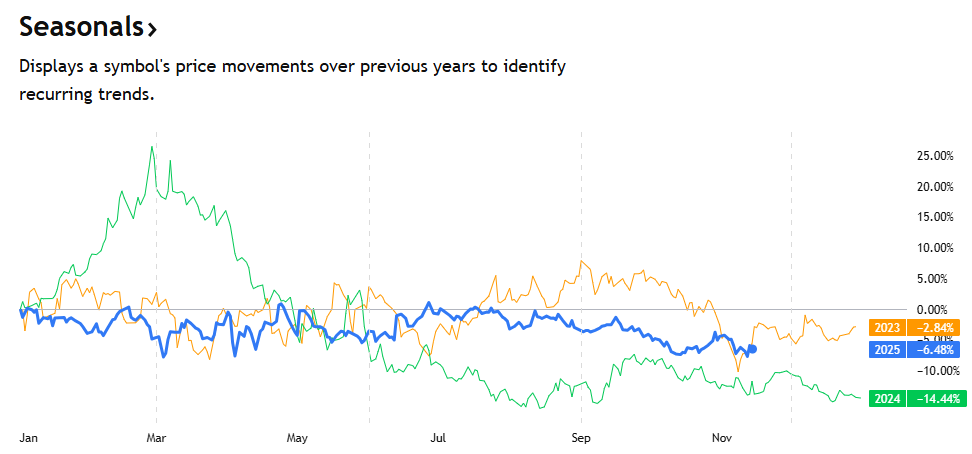

Cotton futures typically show stronger performance in November.

💵 Resistance Zone: 🔴 65.75 – 66.00 USD/lb

📉 A potential profit-taking area or range-top resistance for short-term traders.

📊 Open Interest: 📄 155.97K contracts

🪙 Indicates active participation, with both speculators and hedgers positioning amid market weakness.

🧶 Future Type: 🌾 Cotton (CT1)

📍 Traded on the Intercontinental Exchange (ICE US) — the global benchmark for cotton pricing.

It’s a caution that the information provided is for knowledge purposes only and should not be taken as a recommendation to buy or sell assets.