🌴 Palm Oil Futures (FCPOG2026) — Market Snapshot 🌴

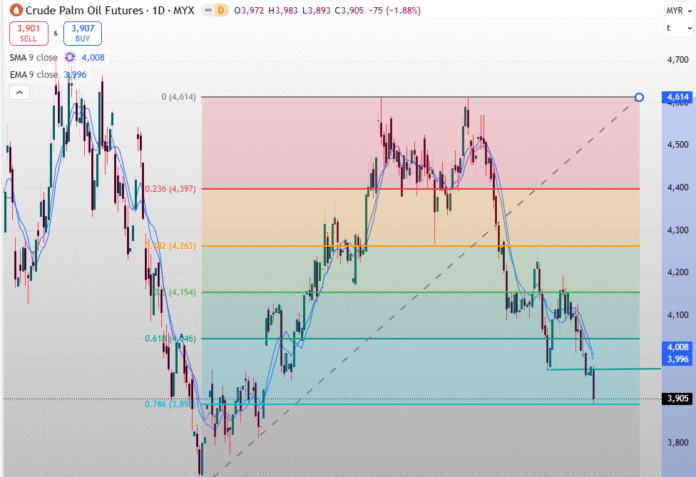

📉 Trend: Downward

🚀 Cutting the export duty to 9.5%.

🌏 Crude oil prices fall.

📊 Technical Indicator: 🔁 Support & Resistance

🧭 Major resistance remains at 3,891 MYR/ton a crucial level to watch for a breakout.

💰 Support: 🔹 3,847 MYR/ton

🎯 Traders watching for reversal signals around this zone for short-term entries.

📈 Open Interest: 94.96K contracts

🪙 Indicates moderate participation — possible buildup before next move.

🛢️ Future Type: Crude Palm Oil (FCPOG2026)

🌾 Benchmark Malaysian palm oil futures traded on Bursa Malaysia Derivatives.

It’s a caution that the information provided is for knowledge purposes only and should not be taken as a recommendation to buy or sell assets.