🌾✨ U.S. Wheat Futures (ZWH2026) — Market Snapshot ✨🌾

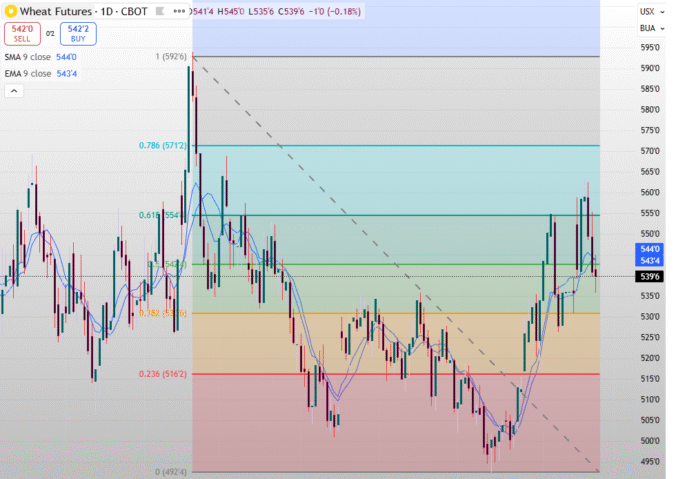

📈 Trend: Prices hit four-month high of $5.55 set on November 5th.

📉 Aggressive near-term buying and tight prompt availability.

🌍 US Gulf and PNW FOB values continue to firm.

🚢 Export inspections show solid year-to-date shipments.

📊 Technical Indicator: 📉 RSI: 46.43 — neutral momentum

🔁 Fibonacci Retracement levels in play, with prices gradually edging toward the 38.2% level.

💰 Support: 🟢 530 USD/bu & 516 USD/bu

🎯 Remain cautious: Oversupply and surplus stocks may keep prices under pressure.

💵 Resistance Zone: 🔴 550 USD/bu

📉 Traders watching this area for potential profit-taking or short entries.

📊 Open Interest: 📄 220.13 K contracts

🪙 Indicates active participation and consistent interest in wheat positioning.

🛢️ Future Type: 🌾 U.S. Wheat (ZWH2026)

📍 Traded on the Chicago Board of Trade (CBOT) — a global benchmark for wheat pricing.

It’s a caution that the information provided is for knowledge purposes only and should not be taken as a recommendation to buy or sell assets.