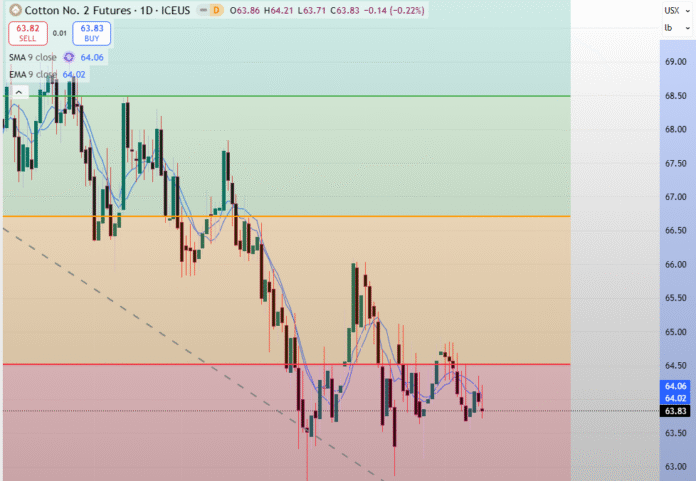

🧵✨ Cotton Futures (CTH2026) — Market Snapshot

📉 Trend: Range Bound

💵 Global cotton production was slashed by nearly 300,000 bales to 119.79 million bales.

🌍 Global consumption was also lowered by almost 300,000 bales.

📊 Technical Indicator: 🔁 Fibonacci Retracement

🐦 The moving averages (MA20 ≈ ~63.95¢, MA50 ≈ ~63.99¢) act as near-term resistance. Breaking below the 50-day MA head towards previous support (~64¢).

💰 Support: 🟢 63.7 USD/lb

🎯 Caution: Cash trades at 61.58 vs. March futures at 63.83, leaving a 2-cent gap.

💵 Resistance Zone: 🔴 65.75 – 66.00 USD/lb (Short term 64.52 USD/lb)

📉 A potential profit-taking area or range-top resistance for short-term traders.

📊 Open Interest: 📄 181.63K contracts

🪙 Indicates active participation, with both speculators and hedgers positioning amid market weakness.

🧶 Future Type: 🌾 Cotton (CTH2026)

📍 Traded on the Intercontinental Exchange (ICE US) — the global benchmark for cotton pricing.

It’s a caution that the information provided is for knowledge purposes only and should not be taken as a recommendation to buy or sell assets.